How Florida Drivers Are Adapting to Rising Insurance Rates

Rising auto insurance premiums are putting a strain on your wallet, forcing many to rethink how they choose their coverage. This impact is even more noticeable for those living in areas like Florida, where hurricanes and severe weather are common. As costs climb, people are searching for ways to save money while maintaining essential coverage.

Bundling insurance policies for different properties can help reduce costs, especially if the properties are in various locations. However, if all your properties are in Florida, the potential savings may be minimal.

To navigate these changes, flexibility and proactive planning are key. Many Florida drivers are switching to user-based insurance, such as pay-as-you-drive plans, as a way to combat increasing auto insurance premiums. These plans not only help save money but also reward safe driving habits. By exploring innovative options, you can better manage your expenses and protect your finances.

Key Takeaways

Car insurance rates in Florida are rising due to bad weather, expensive repairs, and many drivers without insurance.

Pay-as-you-go insurance lets you save money by driving safely and paying for the miles you drive.

Checking prices from different companies can save you a lot; some people save hundreds by changing their insurance.

Putting your car and home insurance together can give you discounts and make things easier to handle.

Learning about discounts and using tools like tracking devices can help you pay less for insurance.

Why Are Auto Insurance Premiums Increasing in Florida?

Key Factors Driving the Increase

Auto insurance costs in Florida have gone up a lot. In 2013, the average yearly cost was $1,364. By 2023, it jumped to $2,560—an 88% increase. Here are some reasons why:

Rising repair costs: New cars have high-tech features. Fixing them costs more, which raises insurance prices.

Severe weather events: Hurricanes and storms in Florida damage cars. This leads to more claims and higher costs.

Uninsured drivers: Over 20% of drivers in Florida don’t have insurance. This makes insured drivers pay more.

In 2023, Florida car insurance costs went up by 24%. This makes it one of the priciest states for drivers. Many are now looking for ways to save money.

Projections for 2025 and Beyond

The future of car insurance costs looks tough. Experts predict that people will spend more of their income on insurance. By 2024, the affordability index may rise to 1.7%, meaning insurance will take up a bigger part of your budget.

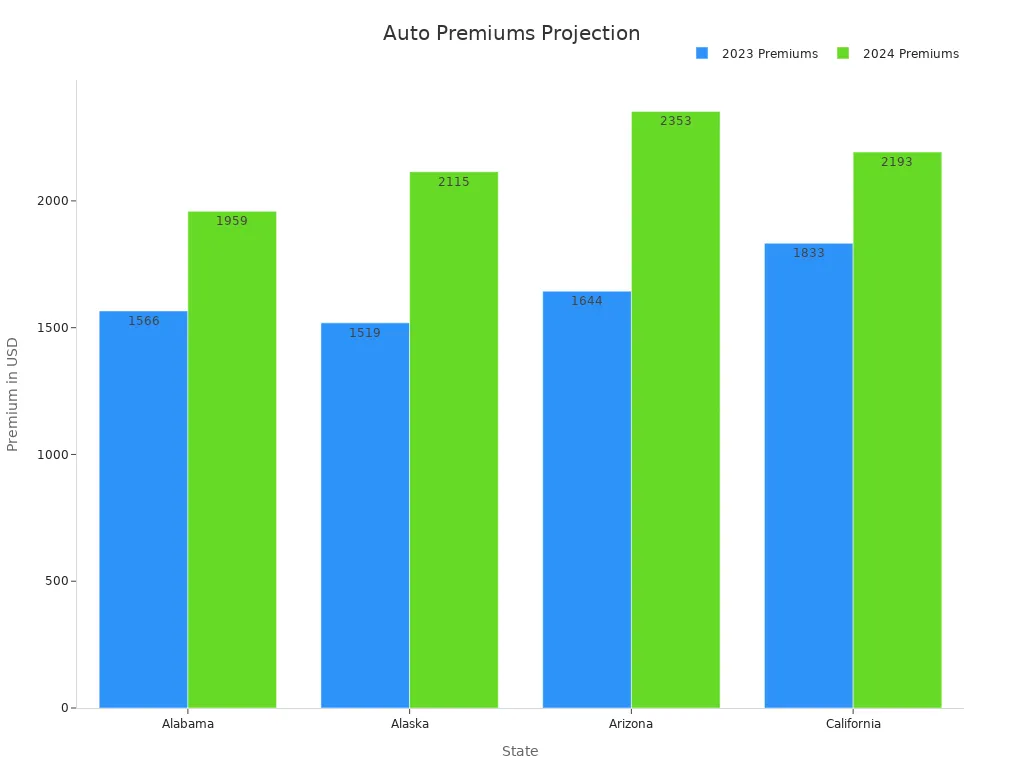

Here’s how Florida compares to other states for future insurance costs:

State | Average Annual Premium in 2023 | Avg. Annual Premium in 2024 | % Difference |

|---|---|---|---|

Alabama | $1,566 | $1,959 | 25% |

Alaska | $1,519 | $2,115 | 39% |

Arizona | $1,644 | $2,353 | 43% |

California | $1,833 | $2,193 | 20% |

By 2033, Florida’s average yearly insurance cost could hit $4,813. This would be much higher than the national average. Staying informed and planning ahead can help you manage these rising costs.

Regional and Demographic Differences in Insurance Costs

Variations Across Florida Areas

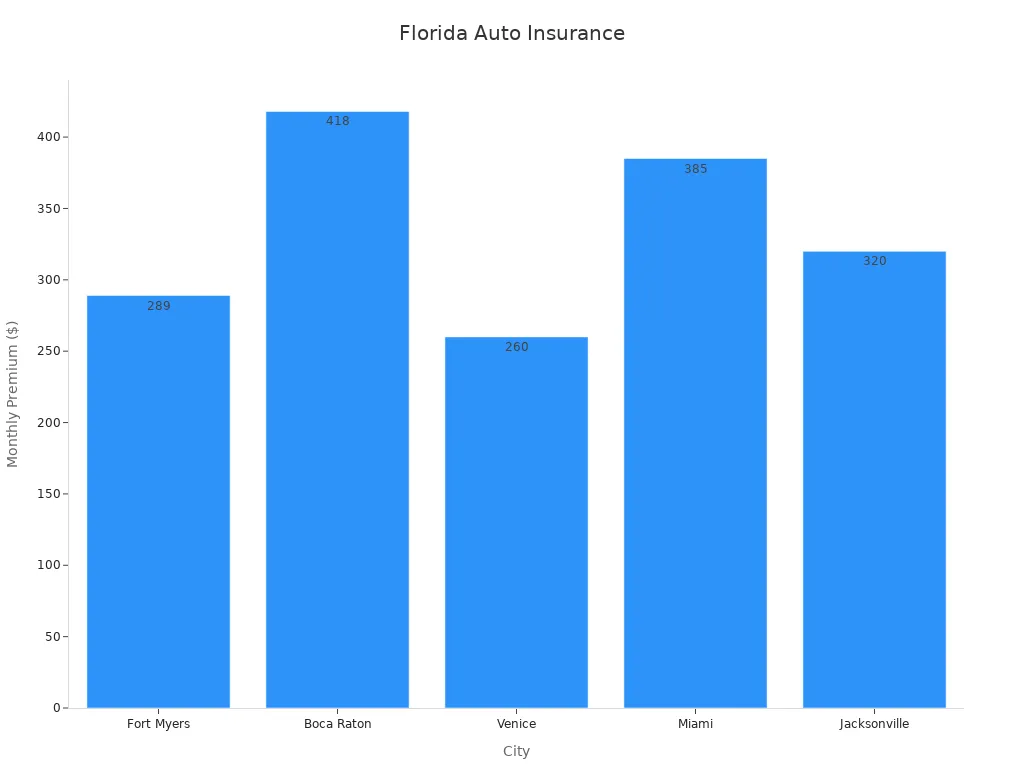

Car insurance costs in Florida differ based on where you live. Cities with more people, traffic, and crime usually have higher rates. For instance, drivers in Boca Raton pay $418 monthly for full coverage. In Venice, the cost is only $260. This happens because of traffic levels and luxury car numbers.

Here’s a look at average monthly costs in some Florida cities:

City | Average Monthly Cost (Full Coverage) | Reasons for Cost Differences |

|---|---|---|

Fort Myers | $289 | Fewer people, less traffic, and lower crime. |

Boca Raton | $418 | More people, heavy traffic, and many luxury cars. |

Venice | $260 | Fewer people, less traffic, and more retirees. |

Miami | $385 | Crowded city, bad traffic, and higher crime. |

Jacksonville | $320 | Big city with medium traffic and mixed driving areas. |

Coastal places like Miami and Boca Raton have higher costs due to hurricanes and floods. Inland areas, like northern Florida, often have lower rates because they face fewer weather risks.

Effects on Different Groups (e.g., age, driving record, car type)

Your age, driving record, and car type affect your insurance price. Young drivers under 25 pay the most because they lack experience. Middle-aged drivers get lower rates, but seniors might pay more due to age risks.

Your driving record also matters. Accidents or tickets make you seem risky, so costs go up. A clean record can help you pay less.

The car you drive is important too. Sports cars or cars that are easy to steal cost more to insure. But cars with safety features might get discounts, saving you money.

Factor | Details |

|---|---|

Driving Record | Accidents and tickets raise costs; clean records lower them. |

Age | Young drivers pay the most; middle-aged drivers pay less; seniors may pay slightly more. |

Car Type | Sports cars and theft-prone cars cost more; safety features can lower costs. |

Knowing these differences helps you pick the right coverage and save money. Choose a safer car, keep a clean record, and look for discounts to lower your insurance costs.

Challenges Florida Drivers Face Due to Rising Premiums

Affordability Concerns

Florida's rising auto insurance premiums are causing money problems for many. The state is the second most expensive for full coverage. On average, it costs $3,244 yearly, and by 2025, it may reach $3,500. Inflation, frequent crashes, and bad weather make it harder for families to pay for insurance.

Here are some reasons for this affordability issue:

Factor | Florida's Status |

|---|---|

Average Expenditure | $1,342 (30% higher than national average) |

Expenditure as % of Income | 2.39% of median household income |

Accident Frequency | 10% above national average |

Repair Costs | Increasing faster than national average |

Injury Claim Frequency | 40% higher than national average |

Uninsured Motorists Rate | One of the highest in the nation |

Litigation Climate | Ranks near the bottom in fairness and reasonableness |

Insurance companies are raising rates quickly. For instance, State Farm raised rates by 30.2% through three hikes. Progressive increased rates over 30% with four hikes. Liberty Mutual raised premiums by 44.3% on average. These increases leave fewer affordable choices, making families rethink their budgets or coverage.

Tip: Shop around for better rates and look for discounts to save money.

Coverage Limitations and Trade-Offs

With higher premiums, you might need to make tough choices. Many people lower their coverage or raise deductibles to save money. But these changes can leave you at risk during accidents or disasters.

Usage-based insurance (UBI) could help. These plans track your driving and reward safe habits with discounts up to 40%. You may also get a 5% to 10% discount when you sign up. About half of U.S. drivers say they drive better after joining these programs. This can save money while keeping good coverage.

Note: Make sure your driving fits UBI rules to get the most savings.

Balancing costs and coverage takes planning. By trying UBI and driving safely, you can save money without losing important protection.

Florida Drivers Turning to User-Based Insurance to Save Money

What Is Usage-Based Insurance?

Usage-based insurance (UBI) is a new way to calculate car insurance. Instead of just looking at your age or where you live, UBI checks how you drive. It tracks things like how far you go, how fast you drive, and how often you stop suddenly. This makes insurance costs fairer because they are based on your actual driving.

More people are choosing UBI to deal with rising insurance prices. Since 2016, the number of drivers using UBI has doubled, with 16% now enrolled. Many drivers are unhappy with regular insurance, which scored 769 out of 1,000 in a 2022 survey. UBI users, however, were 59 points happier than those with standard plans. This shows UBI not only saves money but also gives a better experience.

With insurance prices expected to rise by 8.4% this year, UBI is a smart choice. Full coverage insurance could cost $1,780 a year, but UBI helps you control these costs. For Florida drivers, switching to UBI is becoming a popular way to handle rising expenses.

How Telematics and Pay-As-You-Drive Work

Telematics technology is key to UBI. It uses devices or apps to track how you drive, like your speed, mileage, and braking. This data helps insurers reward safe drivers with discounts. Pay-as-you-drive plans, a type of UBI, charge you based on how much you drive. If you drive less, you pay less.

Big insurance companies offer telematics programs for safe drivers. For example:

Insurance Company | Program Name | Benefits for Safe Drivers |

|---|---|---|

Progressive | Snapshot | Tracks driving habits and offers discounts for safe driving. |

State Farm | Drive Safe & Save | Monitors driving behavior and rewards safe drivers with discounts. |

Geico | N/A | Offers competitive rates influenced by telematics. |

These programs encourage safer driving and help you save money. Progressive’s Snapshot gives discounts based on your driving data. State Farm’s Drive Safe & Save rewards careful drivers. Even Geico uses telematics to offer better rates, even without a specific program name.

Pay-as-you-drive plans are great if you don’t drive much. You only pay for the miles you travel, which is perfect for retirees, remote workers, or anyone who drives less. For Florida drivers, these plans are a flexible way to lower costs.

Tip: Ask your insurance company if they offer telematics discounts. Safe driving could save you up to 40%.

By using telematics and pay-as-you-drive plans, you can cut costs and drive more safely. These options are helping Florida drivers adjust to rising insurance prices.

Strategies for Handling Higher Auto Insurance Costs

Comparing Rates to Save Money

Looking at different insurance rates can help you save money. By checking quotes from various companies, you might save hundreds each year. Last year, 42% of people thought about switching insurance companies to find better deals.

Car insurance costs have risen by over 20% in the past year. This makes it important to explore your options. Many companies offer discounts to attract new customers. Switching to a cheaper company could save you a lot of money annually.

Evidence Type | Details |

|---|---|

Cost Increase | Car insurance prices rose over 20% in the last year. |

Customer Trends | 42% of people considered changing insurance companies last year. |

Savings Potential | Switching companies could save you hundreds of dollars each year. |

Tip: Use online tools to compare rates quickly. This saves time and helps you find the best deal.

Combining Policies for Discounts

Combining your insurance policies can lower your costs. Many companies give discounts if you bundle auto insurance with home or renters insurance. These discounts can be between 5% and 25%, depending on the company and policies.

For Florida drivers, bundling can be helpful. If you own more than one property or car, putting them under one company can simplify things and lower costs. However, if your properties are in risky areas like Florida, savings might be smaller.

Callout: Bundling saves money and makes managing insurance easier. You’ll have fewer bills and one contact for claims.

Driving Safely to Reduce Costs

Driving safely is a smart way to lower your insurance costs. Insurance companies reward safe drivers with lower rates. Programs like usage-based insurance (UBI) track your driving and give discounts for good habits like safe speeds and smooth braking.

Studies show UBI users improve their driving by 9% over 32 months. This not only makes roads safer but also saves money. Safe driving can cut premiums by up to 40%, making it a great way to manage costs.

Study Focus | Results | Time Frame | Number of People |

|---|---|---|---|

UBI Driving Improvement | 32 months | 100,000 drivers |

Tip: Join a telematics program from your insurance company. These programs track your driving and reward safe habits with discounts, helping you save money.

By driving carefully, you can lower your insurance costs and make roads safer. This is especially useful for Florida drivers using user-based insurance to handle rising premiums.

Exploring Discounts and Incentives

Finding discounts and rewards can lower your auto insurance costs. Many Florida drivers miss these chances, but learning about them can save money. Insurance companies offer discounts based on how you drive, your car’s features, and even your lifestyle. Here’s how to use these savings.

Common Discounts You Should Know About

Insurance companies give discounts to drivers who meet certain rules. Knowing about these discounts can help you pay less without losing coverage. Here are some common ones:

Safe Driver Discounts: A clean driving record can get you lower rates.

Vehicle Safety Features: Cars with airbags, anti-lock brakes, or cruise control often qualify. For example, GEICO offers up to 23% off for airbags.

Low Mileage Discounts: Driving fewer miles each year can reduce your costs. This is great for retirees or remote workers.

Bundling Discounts: Combining auto insurance with home or renters insurance can save 5% to 25%.

Good Student Discounts: Students with good grades may get lower rates because they’re seen as safer drivers.

Tip: Ask your insurance agent about all the discounts you qualify for. Many people miss savings because they don’t ask.

Using Vehicle Safety Features

Your car’s safety features can help lower your insurance costs. Insurers often give discounts for cars with advanced safety tools. Features like anti-lock brakes, lane warnings, and cruise control make driving safer and cheaper. Some insurers apply these discounts automatically, so check if your policy includes them.

Safety Feature | Possible Discount Amount |

|---|---|

Anti-lock Braking System | Up to 10% |

Airbags | Up to 23% |

Adaptive Cruise Control | Varies by company |

Knowing how these features affect your costs helps you choose wisely when buying a car. If you’re shopping for a new car, pick one with advanced safety tools to save more.

Why Comparing Rates Helps

Looking at quotes from different companies is a great way to save. Prices vary a lot, and comparing ensures you get the best deal. Many companies offer discounts to attract new customers, so switching could save you hundreds each year.

Callout: Use online tools to compare rates fast. These tools help you find the best deals without much effort.

By finding discounts and rewards, you can control your insurance costs. Whether it’s safe driving, using safety features, or comparing rates, these tips help you handle rising premiums better.

Emerging Trends and Innovations in Auto Insurance

Role of Technology in Managing Costs

Technology is changing how people handle auto insurance costs. New companies, called InsurTech, use smart tools to make things easier and clearer. Artificial intelligence (AI) helps process claims faster and with fewer mistakes. This means quicker approvals and better results for you. Blockchain is also helping by using smart contracts. These contracts reduce paperwork and stop fraud. These tech changes save money for insurers, which can mean lower costs for you.

In Florida, technology is already helping. Insurers use telematics to check driving habits and give discounts to safe drivers. This not only makes people drive better but also helps them save money. More insurance companies are now working in Florida, creating competition. This, along with new tech, is helping keep premiums steady.

Tip: Choose insurance companies that use tools like telematics or AI. These can save you money and make things easier.

Legislative and Regulatory Changes Impacting Rates

New laws in Florida aim to make insurance fairer and cheaper. For example, House Bill 7073 asks insurers to give discounts, lowering costs for many. Senate Bill 7052 makes sure companies follow fair rules. These laws protect you from sudden price jumps or unfair cancellations.

Here’s a quick look at some important changes:

Legislative Change | Description | Impact on Insurance Rates |

|---|---|---|

Citizens Rate Increase Limitations | Limits how much rates can go up for Citizens users. | Keeps rates steady in certain cases. |

Roof Inspections | Lets contractors check roof conditions. | May change costs based on roof quality. |

Prohibition on Cancellations | Stops policy cancellations after hurricane repairs. | Protects against sudden price increases. |

These changes are already helping. Fewer lawsuits are happening over claims, and some insurers are even lowering rates. This could mean more stable prices for you soon.

Future of Insurance in Florida

The future of auto insurance in Florida looks bright with new ideas and rules. Experts think technology will keep improving things. AI and blockchain will likely be used even more, making insurance faster and easier. Telematics programs will grow, offering prices based on how you drive.

Florida’s insurance market is also getting more competitive. More companies are offering policies, giving you more choices. Plus, reinsurance costs for Florida companies have dropped, which might lower your premiums.

But there are still problems. Florida is the second most expensive state for insurance compared to income. To save money, stay updated on new trends and use tech tools and discounts.

Callout: Technology and new laws are making Florida’s insurance market better. Stay informed to take advantage of these changes.

Dealing with higher insurance costs means taking action. Using usage-based insurance and driving safely can lower your premiums. Combining policies or adding security features shows insurers you’re responsible, which might earn discounts.

Tip: Keep a clean claims record and improve your credit score to reduce costs.

Learning about your options and making smart decisions helps you manage insurance expenses. These steps save money and make handling your coverage easier.

FAQ

How can you lower your car insurance in Florida?

Look for better prices by comparing different companies. Check quotes to find the cheapest option. You can also bundle plans, drive safely, or try usage-based insurance for discounts.

What is usage-based insurance?

Usage-based insurance uses devices or apps to track driving. It checks how far you drive, your speed, and braking. Safe drivers get discounts, and driving less costs less. This works well for people who drive less, like retirees.

Does bundling insurance save money?

Yes, combining car insurance with home or renters insurance can save 5% to 25%. It makes managing insurance easier and cheaper. But savings might be smaller in risky places like Florida.

Are there discounts for cars with safety tools?

Yes, cars with safety tools often get discounts. Features like airbags, anti-lock brakes, and cruise control can lower costs. Ask your insurance company to make sure you get these savings.

What if your insurance keeps getting more expensive?

If costs go up, check your plan and compare prices. Think about switching to usage-based insurance or asking for discounts. A better credit score and clean driving record can also help lower costs.

The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information is not intended to create, and receipt or viewing does not constitute an attorney-client relationship.